Not known Facts About Affordable Bankruptcy Lawyer Tulsa

Table of Contents3 Simple Techniques For Bankruptcy Lawyer TulsaTulsa Ok Bankruptcy Specialist Can Be Fun For AnyoneTulsa Bankruptcy Lawyer Fundamentals ExplainedSome Known Incorrect Statements About Chapter 7 Vs Chapter 13 Bankruptcy A Biased View of Chapter 13 Bankruptcy Lawyer TulsaThe Best Guide To Tulsa Ok Bankruptcy Attorney

People must make use of Chapter 11 when their financial debts exceed Chapter 13 financial obligation restrictions. It hardly ever makes sense in various other instances however has more alternatives for lien stripping and cramdowns on unprotected parts of secured financings. Chapter 12 insolvency is designed for farmers and fishermen. Chapter 12 settlement plans can be much more adaptable in Chapter 13.The ways test looks at your ordinary monthly income for the 6 months preceding your filing day and compares it versus the average income for a similar family in your state. If your earnings is listed below the state typical, you instantly pass and do not need to finish the whole type.

The debt limits are provided in the chart above, and present quantities can be validated on the United State Courts Phase 13 Insolvency Basics webpage. Find out much more regarding The Means Test in Chapter 7 Insolvency and Debt Limits for Phase 13 Personal bankruptcy. If you are married, you can declare insolvency jointly with your partner or separately.

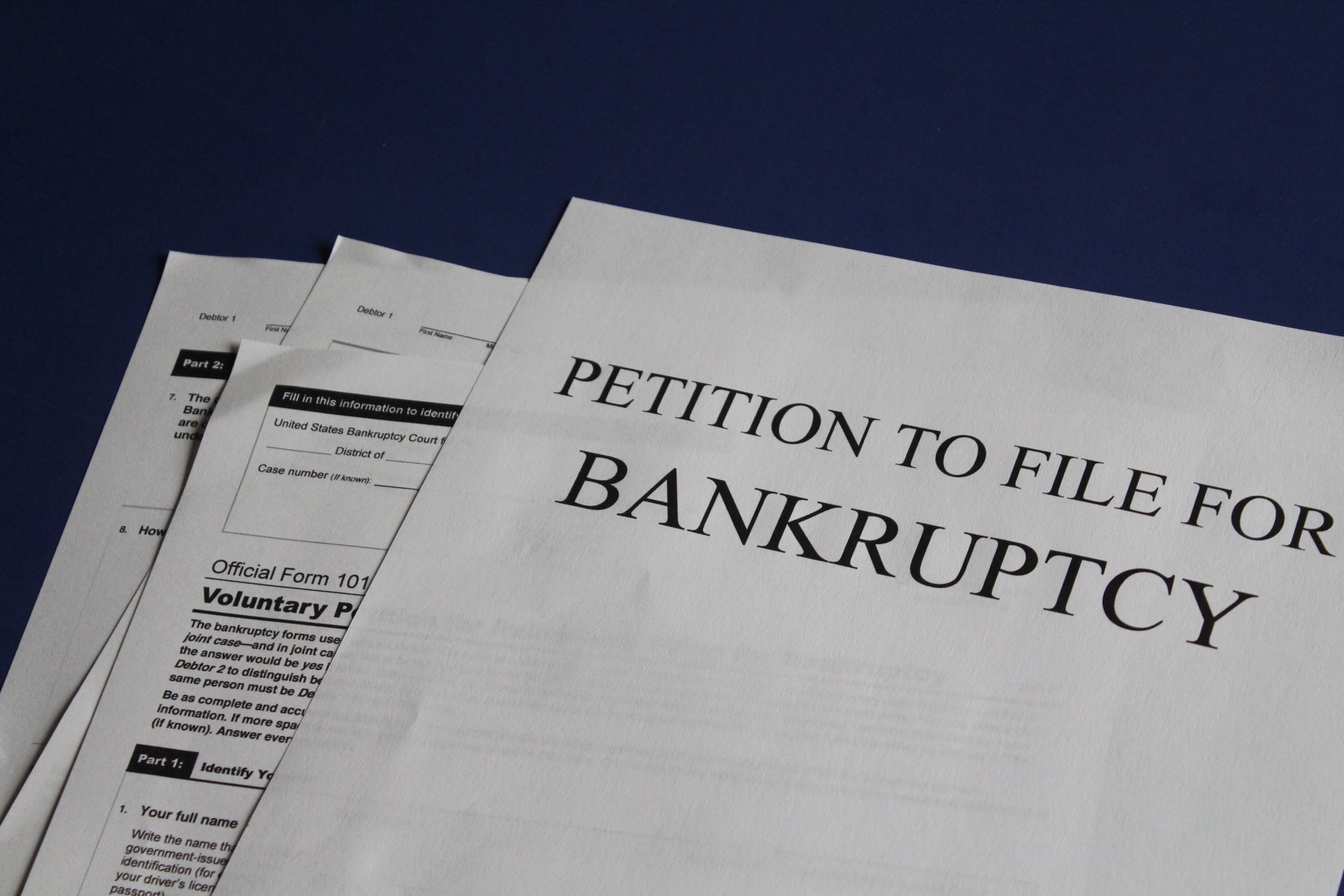

Declaring bankruptcy can help a person by discarding financial obligation or making a strategy to pay off debts. A bankruptcy case generally begins when the debtor submits a request with the bankruptcy court. There are different types of bankruptcies, which are normally referred to by their phase in the U.S. Bankruptcy Code.

:max_bytes(150000):strip_icc()/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png) If you are encountering economic challenges in your personal life or in your service, opportunities are the principle of filing insolvency has actually crossed your mind. If it has, it also makes good sense that you have a great deal of bankruptcy questions that require responses. Lots of people in fact can not respond to the inquiry "what is insolvency" in anything except general terms.

If you are encountering economic challenges in your personal life or in your service, opportunities are the principle of filing insolvency has actually crossed your mind. If it has, it also makes good sense that you have a great deal of bankruptcy questions that require responses. Lots of people in fact can not respond to the inquiry "what is insolvency" in anything except general terms.Many individuals do not realize that there are several sorts of personal bankruptcy, such as Phase 7, Chapter 11 and Phase 13. Each has its benefits and difficulties, so understanding which is the most effective alternative for your existing situation as well as your future recuperation can make all the distinction in your life.

9 Simple Techniques For Bankruptcy Attorney Tulsa

Chapter 7 is called the liquidation bankruptcy phase. In a chapter 7 personal bankruptcy you can remove, wipe out or release most types of financial obligation.

Many Phase 7 filers do not have much in the method of assets. They may be renters and have an older vehicle, or no vehicle in any way. Some cope with moms and dads, good friends, or brother or sisters. Others have houses that do not have much equity or remain in significant requirement of repair service.

Lenders are not permitted to seek or maintain any type of collection activities or suits throughout the situation. A Chapter 13 bankruptcy is extremely effective due to the fact that it gives a system for debtors to prevent foreclosures and constable sales and stop repossessions and energy shutoffs while catching up on their protected financial debt.

Bankruptcy Law Firm Tulsa Ok for Beginners

A Chapter 13 instance may be beneficial because the debtor is enabled to obtain captured up on mortgages or car lendings without the danger of foreclosure or foreclosure and is permitted to keep both excluded and nonexempt residential or like this commercial property. The debtor's plan is a paper detailing to the personal bankruptcy court just how the debtor recommends to pay existing costs while paying off all the old financial debt balances.

It gives the borrower the opportunity to either offer the home or come to be captured up on home mortgage settlements that have fallen back. A person filing a Chapter 13 can suggest a 60-month strategy to treat or end up being existing on home mortgage settlements. If you dropped behind on $60,000 well worth of mortgage payments, you can recommend a plan of $1,000 a month for 60 months to bring those home loan settlements present.

It gives the borrower the opportunity to either offer the home or come to be captured up on home mortgage settlements that have fallen back. A person filing a Chapter 13 can suggest a 60-month strategy to treat or end up being existing on home mortgage settlements. If you dropped behind on $60,000 well worth of mortgage payments, you can recommend a plan of $1,000 a month for 60 months to bring those home loan settlements present.Tulsa Bankruptcy Filing Assistance Fundamentals Explained

Sometimes it is far better to avoid bankruptcy and work out with financial institutions out of court. New Jersey likewise has an alternative to personal bankruptcy for companies called an Assignment for the Advantage of Creditors and our law firm will certainly go over this choice if it fits as a potential approach for your business.

We have actually created a device that aids you select what phase your file is most likely to be filed under. Click right here to utilize ScuraSmart and find our website out a possible remedy for your financial obligation. Many individuals do not recognize that there are several kinds of personal bankruptcy, such as Phase 7, Phase 11 and Phase 13.

Below at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we manage all sorts of personal bankruptcy situations, so we are able to address your insolvency questions and aid you make the very best decision for your instance. Here is a brief take a look at the financial debt relief options offered:.

Get This Report on Tulsa Bankruptcy Legal Services

You can just declare personal bankruptcy Prior to declare Chapter 7, at the very least among these ought to be real: You have a great deal of financial debt revenue and/or assets a lender can take. You shed your copyright after being in an accident while without insurance. You require your license back (bankruptcy lawyer Tulsa). You have a whole lot of financial debt close to the homestead exception quantity of in your house.

The homestead exemption quantity is the better of (a) $125,000; or (b) the area median sale price of a single-family home in the coming before fiscal year. is the quantity of money you would keep after you offered your home and paid off the home mortgage and various other liens. You can discover the.

Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!